capital gains tax philippines

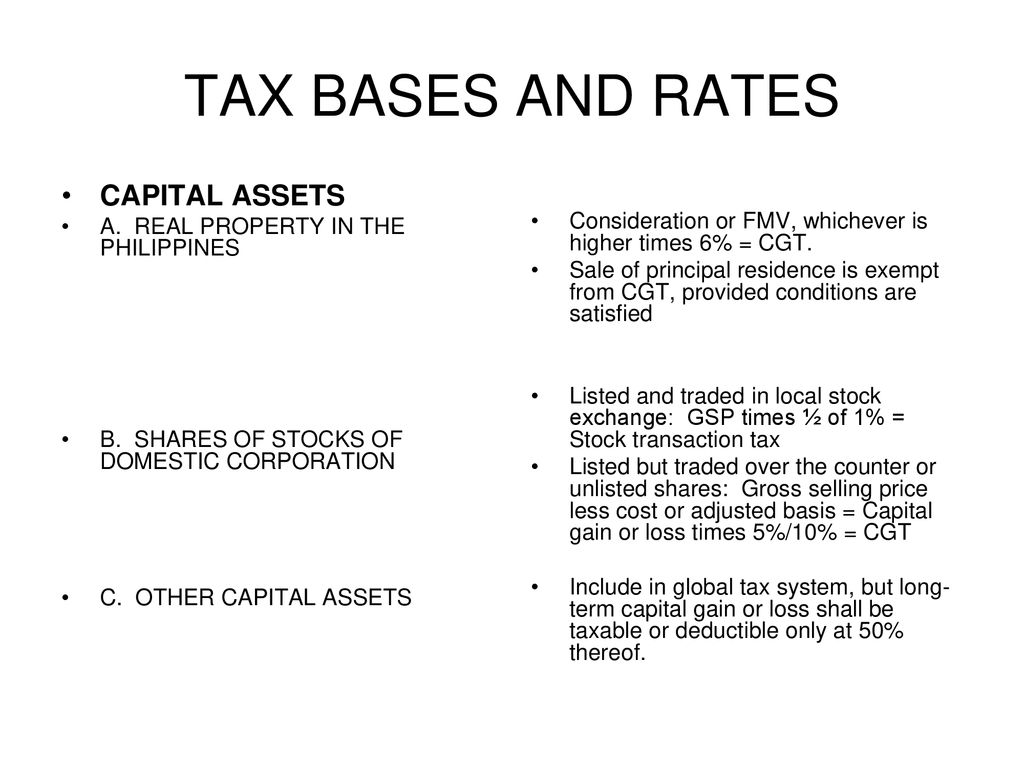

Capital gains tax in the Philippines is imposed upon capital gains presumed to have been realized from the sale exchange or other disposition of genuine property found in the Philippines. A property is considered as a capital asset if it is not used in trade or in business.

Duterte S Economic Managers Not Concerned About Below Target Yield From Train Gma News Online

Which means the price of the shares and the associated promoting bills are deductible.

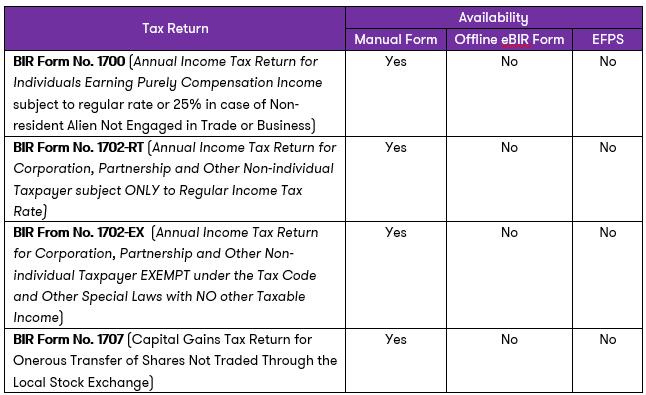

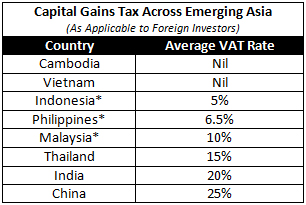

. The tax charge is 5 for the primary P100000 and 10 in extra of P100000 of the web capital positive factors. Capital gains from the exchange or other disposition of real property located in the Philippines. Capital gains generally are subject to the ordinary income tax rates although gains from the sale of certain shares and real property are subject to specific rates.

A capital asset is subject to capital gains tax. Gross amount of income derived from all sources within the Philippines. A Computation of capital gains tax due on the exchange of property by Mr.

The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year. For more details see the Data FAQ Source. For non-resident aliens engaged in a trade or business in the Philippines dividends shares in profits of partnerships taxed as corporations interest royalties prizes in excess of PHP 10000 and other winnings are subject to final withholding tax at a rate of 20 of the gross amount.

Net Capital gains from the sale of shares of stock not traded in the Stock Exchange - Not Over P100000. 5 - Any amount in excess of P100000. Global Property Guide Research Contributing Accounting Firms Philippines does not publish official house price statistics.

The regular income tax for individuals remains at 32. Buendia No capital gains tax is due from Mr. Please note that there is an exception to the application of the CGT and that is the sale of a principal residence your own home.

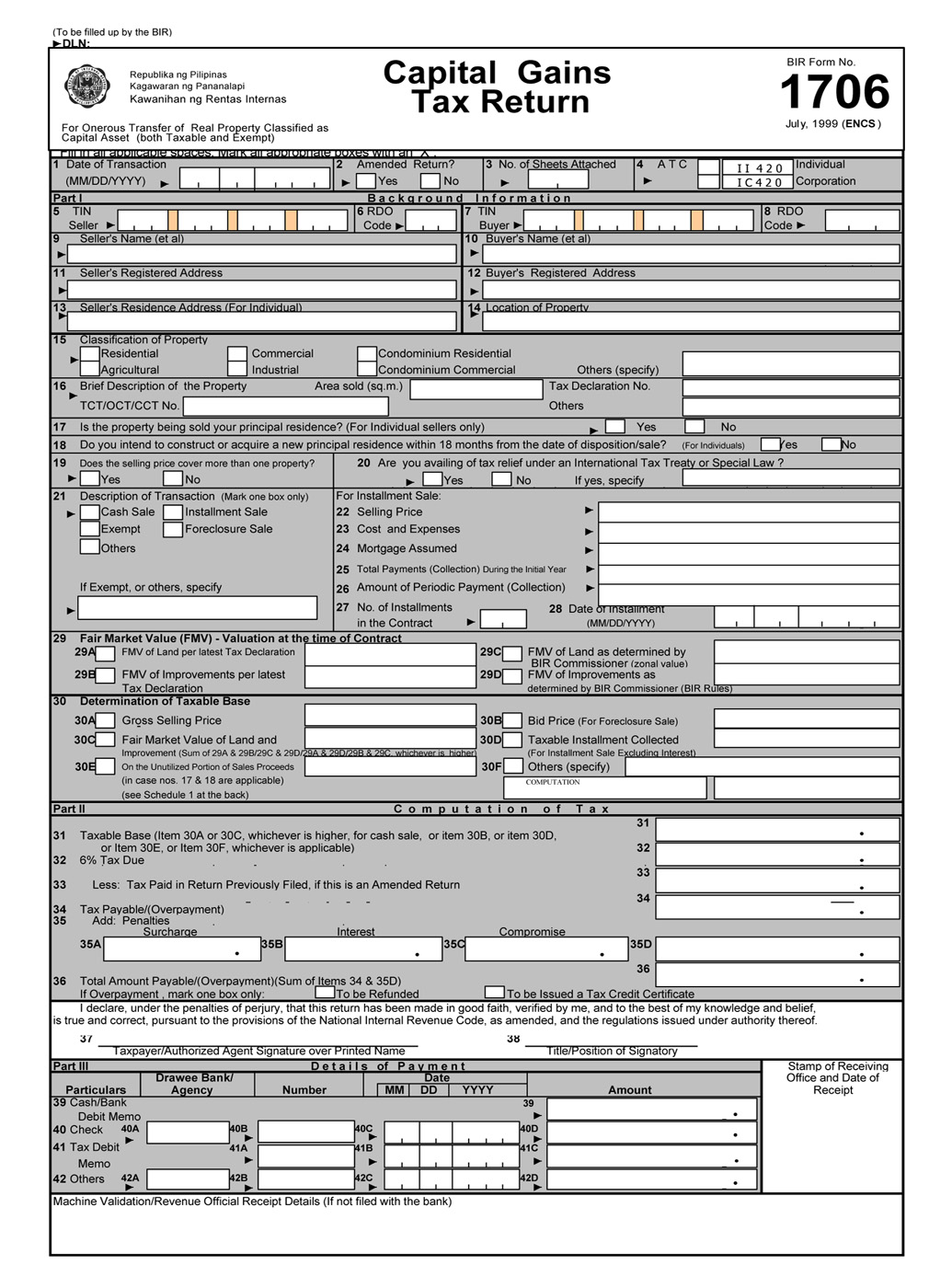

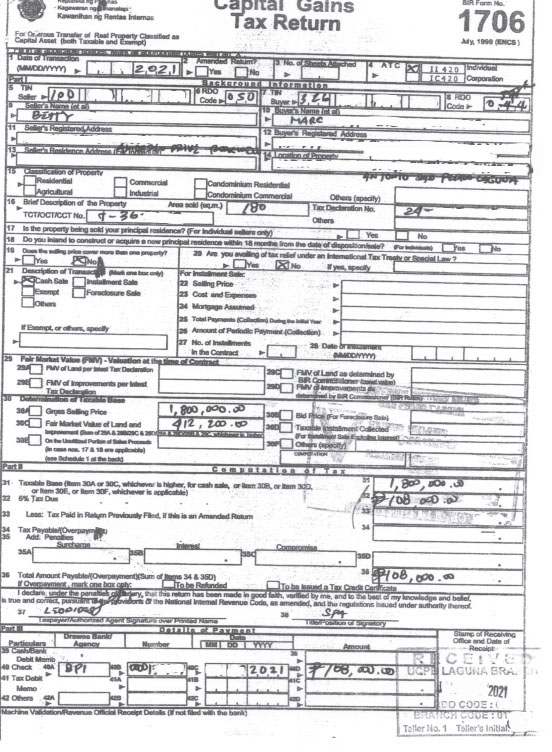

What is a Capital Asset. To calculate the capital gains tax you check the value of the property or its current fair market value whichever is higher and multiply that by 6. To far better appreciate this tax kind let us share you the subsequent overview.

Capital Gains Tax is charged at a flat tax rate of 6 of the gross selling price and must be paid within 30 days after each transaction. - The provisions of Section 39 B notwithstanding a final tax of six percent 6 based on the gross selling price or current fair market value as determined in 24 accordance with Section 6 E of this Code whichever is higher is hereby imposed upon capital gains presumed to have been realized from the sale exchange or other disposition of. But a longer holding period often results in no capital gains tax being payable.

Net capital gain is the difference between the selling price and the FMV of the shares whichever is higher less the shares cost basis plus any selling expenses. Capital gains tax CGT is imposed on both domestic and foreign sellers. For example if the property is valued at Php 1000000 you multiply that by 6 and the total sum of capital gains tax the seller pays is Php 60000.

The Philippine Tax Code grants the Commissioner of Internal Revenue the power to reallocate income and. Buendia for the reason that there has been full utilization of the value of his old principal residence exchanged where in addition to fair market value of his old principal residence of P4000000 he still paid cash of. This deserves a separate discussion as I intend to take advantage of this when we purchase our next residence.

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines including pacto de retro sales and other forms of conditional sale. Php 1000000 x 6 Php 60000. In many countries a holding period of less than 5 years results in capital gains being taxable.

An individual is subject to capital gains tax on the sale of real property at a rate of 6 of the higher of the gross sales price or the current fair market value. Capital assets are different from Ordinary Assets.

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Buying Property In The Philippines Youtube

Capital Gains Tax What Is It When Do You Pay It

Taxes And Title Transfer Process Of Real Estate Properties This 2021

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

How To Compute Capital Gains Tax On Sale Of Real Property Business Tips Philippines

How Are Dividends Taxed Overview 2021 Tax Rates Examples

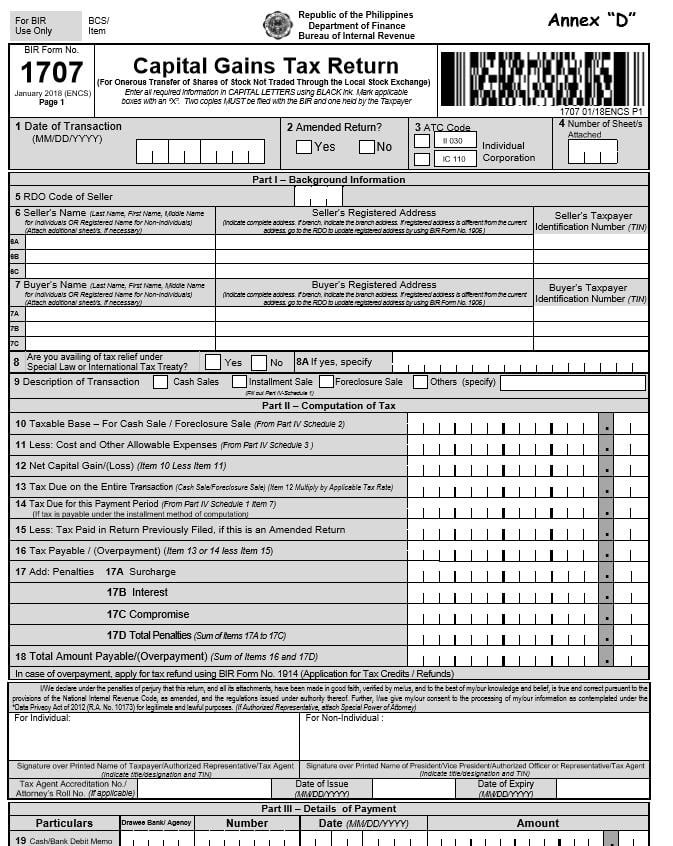

Bir Form 1706 Fill Online Printable Fillable Blank Pdffiller

Capital Gains On Selling Property In Orlando Fl

How To Compute File And Pay Capital Gains Tax In The Philippines An Ultimate Guide Filipiknow

How To Compute Capital Gains Tax Train Law Youtube

How To Compute Capital Gains Tax When And Where To File And Pay Real Estate 101 Philippines Youtube

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

How To Compute Capital Gains Tax When And Where To File And Pay Real Estate 101 Philippines Youtube

Capital Gains Tax China Briefing News

Income And Withholding Taxes Ppt Download

Capital Gains Yield Cgy Formula Calculation Example And Guide